HMRC Enquiry Support Service for R&D Tax Claims

Most R&D tax claims are processed by HMRC without issue, a small but growing number of submissions face what’s called a compliance check. Compliance check letters from HMRC are enquiry letters. This is when HMRC investigates or request for more information about your R&D claim in order to judge the legitimacy and accuracy. Some enquiries are also launched for random sampling purposes. Whilst an enquiry can be extremely inconvenient, cause delays in receiving the tax credits for your business, they are a vital mechanism for protecting the R&D Tax Relief scheme from abusive claims and ensuring that UK taxpayers receive value-for-money.

Key points to note are:

- The reason for the enquiry can be on the technical and/or the aspect of your claim, random sampling or the size of the claim.

- The compliance check/enquiry letter will have a list of questions designed to collect more financial and/or technical information about your R&D.

- Enquiries can take weeks, months, and sometimes even years to resolve.

If you are facing an enquiry, get in touch with our Innovation Tax Reliefs team to discuss how we can protect your business. You can complete the form on this page or alternatively CLICK HERE to schedule a time with one of our specialists. TAP’s experienced team can work with you and HMRC to resolve the HMRC enquiry, often bringing matters to a prompt and satisfactory conclusion.

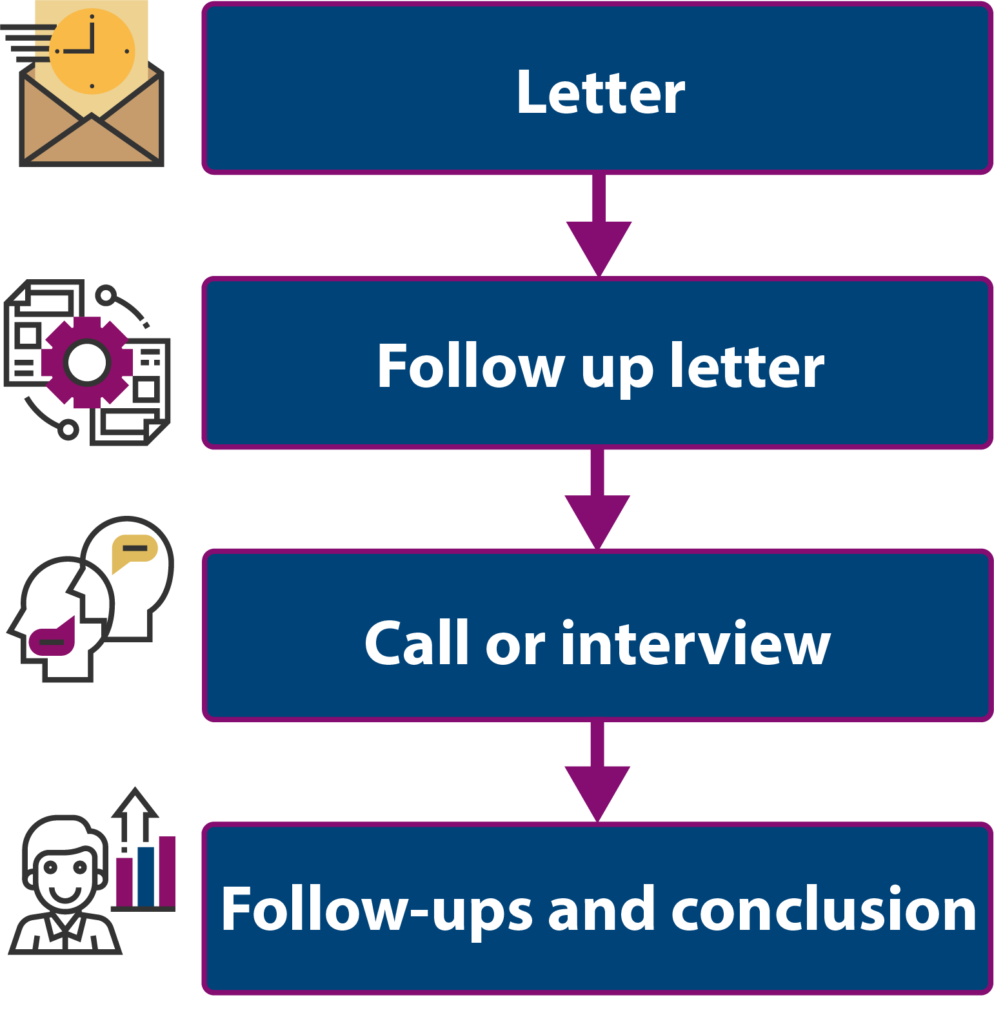

Typical Enquiry Process

The letter initiates the enquiry process and all enquiries begin with a letter in which you will have 30 days to respond. A follow up letter will follow your initial response for further information. A request for a call or interview might then take place with HMRC and the technical and/or financial teams. HMRC will make a decision which you can choose to accept or challenge further.

You may receive what’s called a ‘nudge letter’, asking whether your company’s tax affairs are up to date. Nudge letters often precede an enquiry, so if you’re sent one, start preparing.

Also, if your R&D Tax Credits claim hasn’t been processed after three or four months, and you haven’t heard anything from HMRC, an enquiry letter might be on the way.

If your claim hasn’t been processed after six months, it’s all but certain that you’ll be stuck with a compliance check.

The outcome of enquiries can include delays, significant time to resolve the enquiry, reduced claim size, damaged reputation with HMRC and fines. It is therefore important to ensure your chances of enquiries are reduced by submitting robust claims.

For further information about enquiries or how we can help with your company’s compliance check, get in touch with our Innovation Tax Reliefs team to discuss how we can protect your business. TAP’s R&D Tax relief / Innovation Tax Relief team are ready to work with you to resolve your HMRC enquiry. Click HERE to book a free no obligation call with our R&D team to discuss matters further.