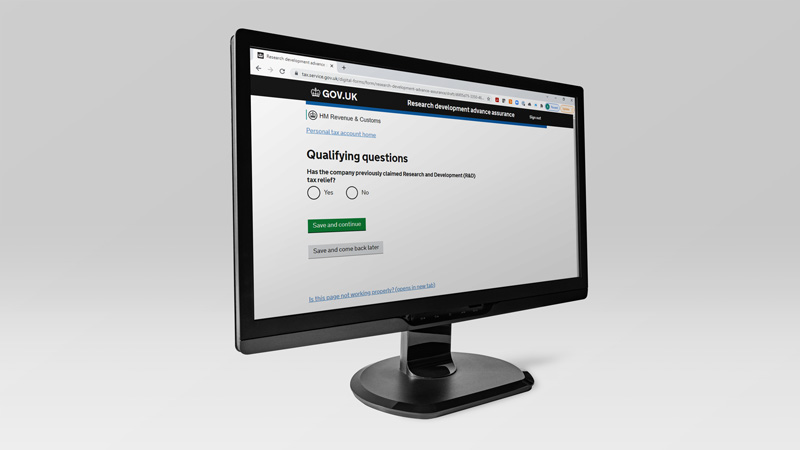

Advance Assurance

If your company is applying for R&D relief for SMEs for the first time, it could qualify for Advance Assurance. This is a voluntary scheme which enables SMEs to contact HMRC in advance of submitting a claim for R&D relief and get confirmation that the activities they carry out will qualify.

The main advantage is that, advance Assurance is used to give companies a guarantee that any R&D claims will be accepted without an enquiry provided they are:

- in line with what was discussed and agreed

- claimed within the first 3 accounting periods

- SMEs also get access to HMRC specialists who can help them with questions about relief.

However, your company does not need Advance Assurance before it applies for R&D tax relief.

Advance Assurance can be applied for before or after the R&D is carried out, but the application has to be made before the first R&D relief claim is made. To be eligible for advance assurance the company must:

- an SME

- planning to do R&D or already have done

- Have made no previous claims for R&D relief;

- Have annual turnover of £2m or less;

- Employ fewer than 50 staff;

- Not be part of a group and none of the companies linked to you have made a claim before

- Not be a serious defaulter

- Not have entered into any scheme which falls under the Disclosure of Tax Avoidance Schemes (DOTAS) regime.

Whilst you can apply for Advance Assurance yourself, we recommend that you speak to us to understand how we can add value and reduce your burden. Please give the team a call on 02080371030 or complete the enquiry form on this page.