In recent weeks HMRC have recommenced a campaign which targets taxpayers that have overseas assets, income and gains, which may not have previously been disclosed to HMRC.

In recent weeks HMRC have recommenced a campaign which targets taxpayers that have overseas assets, income and gains, which may not have previously been disclosed to HMRC.

This letter has been sent because HMRC has received information that suggests the recipient may have overseas income or gains to declare.

This campaign first started in the summer of 2019 and the new letters being issued have been updated to include some subtle but important changes.

As you may be aware, information is provided to HMRC from a variety of sources, but these recent letters from HMRC appear to be specifically prompted as a result of information exchange agreements the UK has entered into with a significant number of overseas jurisdictions.

The agreements entered into are known as Automatic Exchange of Information (AEOI) agreements and the Common Reporting Standard (CRS).

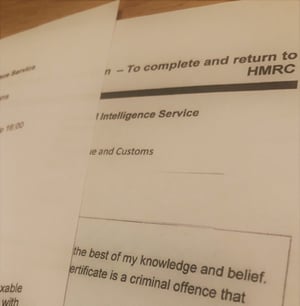

The most recent letters are being issued by HMRC's "Risk and Intelligence Service, Offshore" and confirm that HMRC have compared the clients tax records with the information received before sending the letter. The letter is therefore more targeted than previously, although HMRC still accept there could still be a reasonable explanation for any discrepancy.

This letter does require a formal response and it must be dealt with by the required deadline, typically a month from its issue date.

That response requires careful and serious consideration as HMRC are asking you to certify that your tax affairs are in order and that you do not intend to take any further action, or alternatively that you intend to make a formal disclosure to bring your tax affairs up to date and will therefore register to do so using HMRC’s Worldwide Disclosure Facility.

Failure to take corrective action when it is required will have serious consequences and we therefore recommend that you contact us to discuss how we can assist.

We are specialist tax advisers with significant experience and expertise in assisting non-domiciled, UK resident individuals manage their international tax affairs. For further information on the services we provide for our international clients please follow this link.