We have been made aware by the Chartered Institute of Taxation that, the UK tax authorities, HM Revenue and Customs (“HMRC”) intend to target offshore companies owning UK property.

Read MoreToday Kwasi Kwarteng presented his first budget and with a clear strategy, reduce taxes to stimulate growth!

Some headline changes were already anticipated but the Chancellor pulled a rabbit from the ...

Read MoreThere has been a huge amount of press around the fact that Rishi Sunak’s wife, Akshata Murthy, is a “non-dom” and able to access the “remittance basis of taxation”.In case it isn’t clear this isn’t a ...

In the Autumn Statement of 2021, the Government provided details on a series of measures to reform the R&D tax relief system. These measures are intended to ensure the UK’s R&D tax reliefs are as ...

Read MoreThe 2021 Autumn Budget was delivered today by The Host, the Chancellor of the Exchequer Rishi Sunak.

Read MoreHMRC has warned taxpayers that hold crypto assets, that they should expect to be contacted to verify their tax affairs are in order.As you may be aware, information is provided to HMRC from a variety ...

An interesting recent case (known as Banks vs IRC) shows the need to take tax advice if you are considering making a political donation or are dealing with the estate of a deceased person who has.

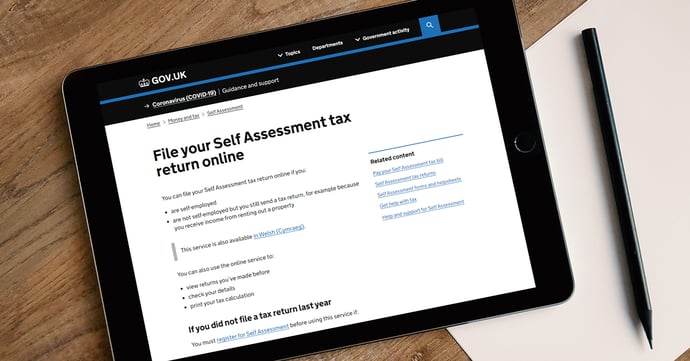

Read MoreHMRC has reminded self-assessment taxpayers to ensure they have the correct information in order to complete their 2020/21 tax return, with the October 31 deadline for submission of paper forms ...

Read MoreWhether a property is residential or commercial for the purposes of Capital Gains Tax (CGT) has an impact on both the timing of the tax due on its disposal and the rate at which it is charged. In a ...